More Revenue: Unlocked

Turn Your Advisory Practice Into a Comprehensive Wealth Management Solution – With No Extra Work

Unlock a new revenue stream while helping your clients navigate critical business transitions. With our Financial Advisor Alliance Program, you can earn 10% of our brokerage or valuation fee simply by introducing clients who need our services. We handle everything—from business valuation to buyer negotiations and closing—while you stay focused on managing their wealth. Plus, we structure our payouts as a client introduction fee for bringing us qualified opportunities, ensuring alignment with industry best practices. No extra work, no risk—just an easy way to increase your practice's revenue.

As a trusted advisor, your clients rely on you for comprehensive financial guidance, but when they're looking to sell their business, transition to retirement, or unlock equity for diversification, do you have a solution in place?

We do! - and we’ll pay you for it.

How it Works

Step 1: Refer a Business Owner

✔ Introduce us to a client looking to sell, buy, or get a valuation.

Step 2: We Handle Everything

✔ We manage the entire process – valuation, buyer search, deal negotiations, financing assistance, and closing.

Step 3: You Get Paid

✔ Earn 10% of our fee as a consulting payment for providing your expertise on the deal.

Why We Created This Program

Atlantic Coast Business Advisors was founded on the conviction that the business brokerage industry requires fundamental transformation. A critical component of this evolution is building meaningful partnerships across the financial services ecosystem.

Through years of industry experience, we've identified several significant challenges:

Financial advisors are often sidelined when business owner clients contemplate selling—despite managing their largest asset outside the business.

Traditional M&A firms predominantly focus on transactions exceeding $20 million, leaving $2M-$20M businesses underserved even though these represent the majority of your business owner clients.

Poor coordination between brokers, wealth managers, business owners, and CPAs significantly diminishes the likelihood of optimal outcomes and smooth transitions to retirement.

Most business owners operate without accurate knowledge of their enterprise's true worth, making retirement planning and diversification strategies nearly impossible to implement effectively.

In response to these challenges, we've developed our Financial Advisor Alliance Program. This initiative ensures every business owner receives exceptional service from a coordinated team of brokers, wealth managers, CPAs, and lenders—regardless of transaction size.

Furthermore, we've revolutionized our valuation methodology to create a dynamic tool that empowers your clients with actionable insights, making your wealth management conversations more productive and data-driven.

-

Earn a steady stream of additional income with minimal effort—many advisors add $40K-$100K+ annually.

-

When you help clients navigate their largest financial transaction, you become irreplaceable—not just an investment manager.

-

You simply introduce us to the client—we handle the valuation, marketing, buyer search, and sale process.

-

When the business sells, you're positioned to manage the proceeds. The average business sale in our range generates $2M-$15M in liquid capital.

-

Most business owners have 70-90% of their net worth locked in an illiquid business. Help them unlock it for proper diversification.

-

We structure our payouts as client introduction fees, a standard practice in the financial services industry.

Why Partner With Us?

Earnings: Unlimited

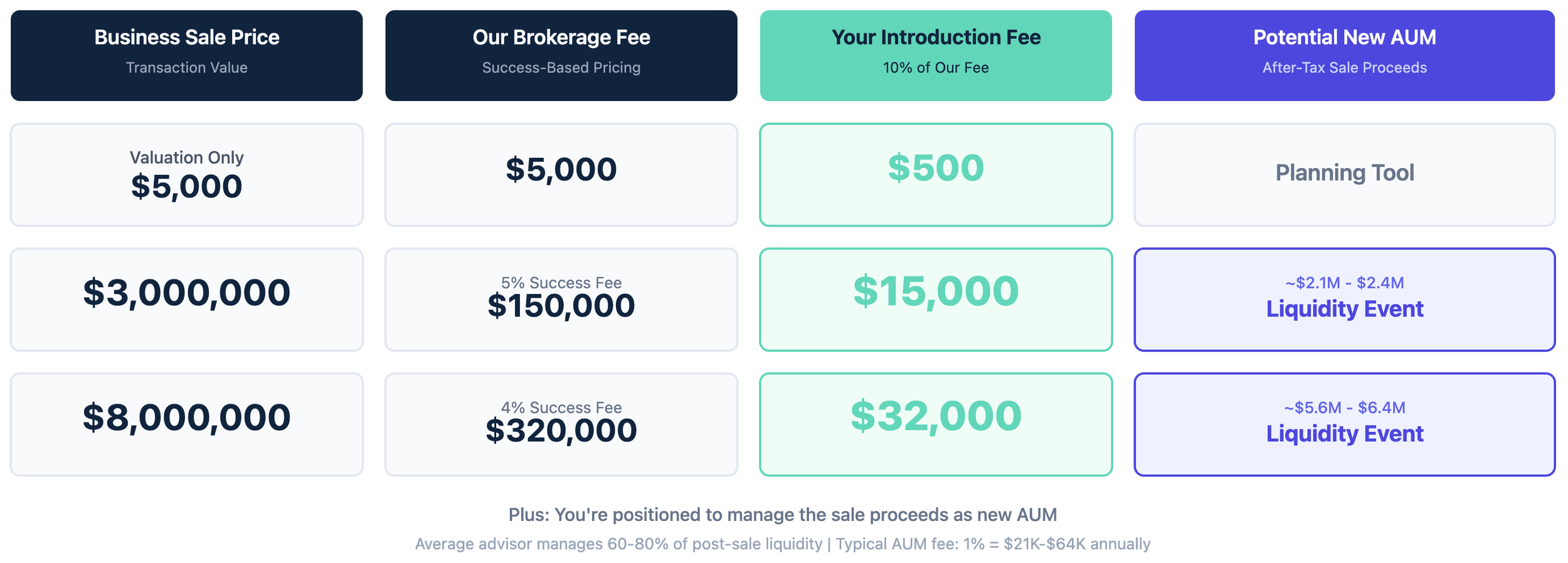

Let’s break it down:

Valuation Services Also Count! Even if a client just needs a professional valuation, you still get paid.

Plus: You're now managing $3M-$8M in new AUM from the sale proceeds.

Partnership FAQs

-

✔ Yes! We pay a client introduction fee, which is standard practice in the financial services industry. We recommend discussing with your compliance department, and we're happy to provide documentation.

-

✔ Absolutely not! We handle 100% of the process. You simply make the introduction and stay updated on progress.

-

✔ No long-term contracts—just a simple alliance agreement outlining the introduction fee structure and terms.

-

✔ Any business owner client thinking about:

Selling within the next 1-5 years

Retirement transition planning

Business valuation for financial/estate planning

Diversifying concentrated wealth

Acquiring another business

-

✔ We provide a dedicated partner dashboard where you can track client progress, deal stages, and expected payouts.

-

✔ No—you're solving a real problem for your client. Their business is often their largest asset and biggest risk. Helping them properly value, plan for, and ultimately exit that business is fundamental to sound wealth management.

-

Ite✔ Perfect! We specialize in Exit Roadmap planning for clients 1-5 years out. We help them increase enterprise value while you manage their investment portfolio—it's completely complementary.

Don’t Just Take Our Word for It

"Finally, a brokerage firm that understands the wealth management perspective. Great communication, professional service, and they keep me in the loop throughout the entire process."

Sarah Chen, CFP®

“Great working relationship and a nice boost to client offerings.”

"Our partnership with Atlantic Coast has been transformational. I've added over $80,000 in introduction fees this year, but more importantly, I'm now managing $12M in new assets from client liquidity events."

James Peterson - Wealth Manager

"I was skeptical at first, but after the first successful sale, I was convinced. My client got a great outcome, I earned $28,000 in fees, and now I'm managing the proceeds. Win-win-win."

Michael Torres - RIA Principal

"Atlantic Coast treats my clients like their own. The professionalism is top-notch, and the partnership dashboard makes it easy to stay informed without being involved in the day-to-day details."

Let’s Start Building Our Partnership Today!

Interested in working together? Fill out some info and we will be in touch shortly! We can't wait to hear from you!